Did not receive verification mail? Please confirm whether the mailbox is correct or not Re send mail

IPR Daily

- 2022-01-21 11:28:17

OpenSea: How Trademark Infringement Is Rampant on The Biggest NFT Marketplace

The OpenSea marketplace sold over $14 billion worth of NFTs in 2021

Investigation finds collections of unauthorised brand-related NFTs

Rights holders urged to monitor OpenSea for trademark infringement

SUMMARY

According to the investigation of WTR, it has uncovered numerous instances of major brand names and logos being sold for thousands of dollars on the NFT marketplace OpenSea. While copyright issues relating to NFTs have been in the spotlight thanks to an outcry from artists discovering stolen works for sale, trademark infringement is also a significant problem that rights holders should be aware of.

Non-fungible tokens (NFTs) are unique, individual tokens existing on a crypto blockchain (such as Ethereum). They are used in several specific applications, most commonly digital collectibles and art, as a means to prove authenticity and ownership. They are also proving to be popular in the digital trading community: the Bored Ape Yacht Club, for example, is an NFT art project featuring 10,000 unique variations of a cartoon ape, and were originally sold for 0.08 Ethereum (around $300) but have been resold for staggering amounts (including one selling for $3.4 million at Sotheby’s last year).

Bored Ape Yacht Club NFT

In recent months, critics of the NFT market have targeted the significant rates of copyright infringement reported by artists and content creators. Numerous exasperated artists describe the stressful experience of discovering their work being sold on OpenSea – often by anonymous users who are presumed to be automated bots – and the difficult process of trying to get the listings taken down, described by one as “an endless, unbeatable game of Whack-a-Mole”.

What is less talked about is the potential trademark infringement threat for major brands, some of which have (or are considering) dipping their toe into the NFT arena (including companies such as Taco Bell, Coca-Cola, Mattel, Ray-Ban, Asics, NFL, and Gucci). To date, the number of lawsuits between major brands and NFT sellers for trademark infringement has been relatively low.

Notably, while lawsuits are currently few and far between, big brands are clearly being targeted by NFT sellers on the OpenSea platform. WTR discovered dozens of accounts that are selling major brand names and logos. For example, the OpenSea user ‘OriginalTokenArt’ has over 100 listings selling the names of major brands for $18,800 each. Company names being sold include Microsoft Corp, Dell Inc, The Boeing Company, Barclays, Morgan Stanley, and Verizon. Any buyer would then be able to sell NFTs with the collection name of a major brand (eg, ‘opensea.io/collection/brand’), in activity that is similar to cybersquatting.

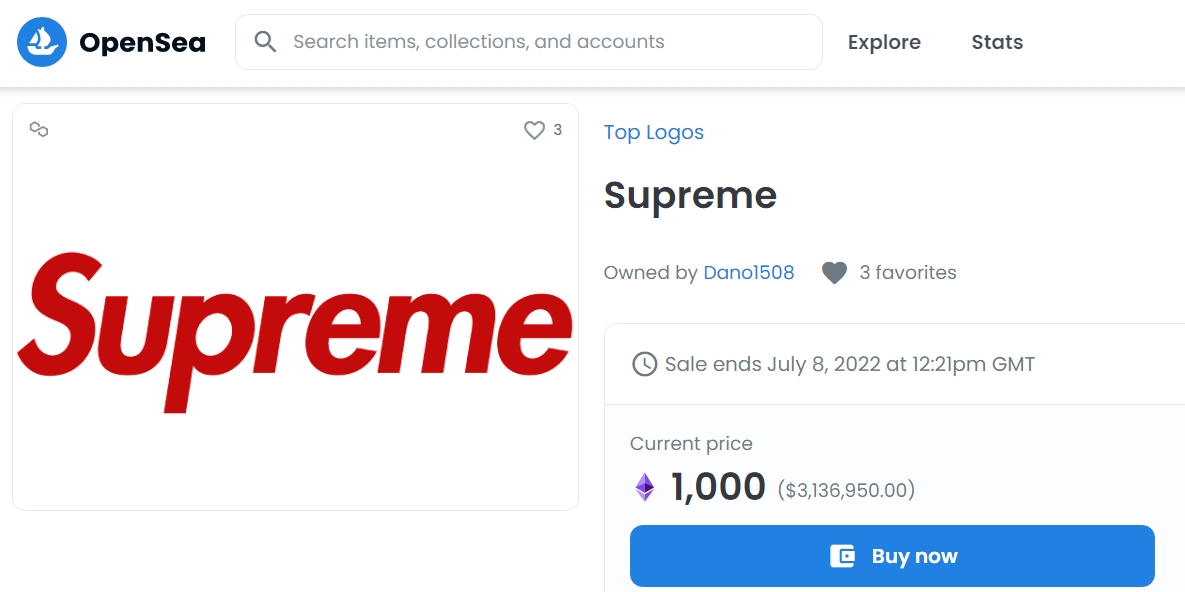

The logo of fashion brand Supreme is on sale for over $3 million on OpenSea

There are also OpenSea users dedicated to selling the logos of major brands as NFTs. Arguably the leader in this field is the user ‘Top Logo’, which has over 5,000 listings of logos, hundreds of which have sold for hundreds and even thousands of dollars. Unsurprisingly, most major brands are impacted, from entertainment and sports franchises to financial and technology conglomerates – with the highest prices being for the logos of Supreme (priced at a staggering $3.1 million) and Bank of China ($313,000).

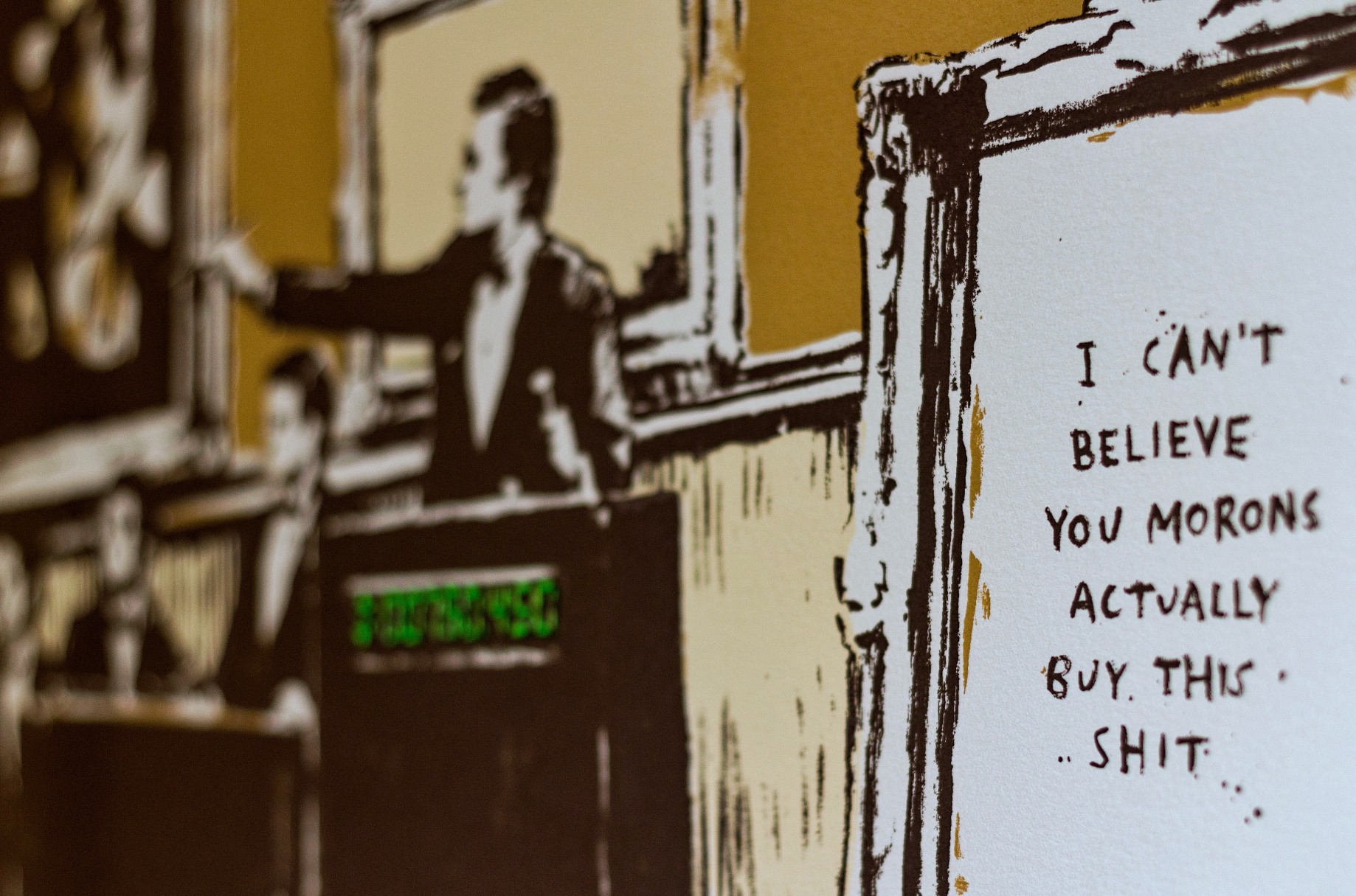

Of course, many of the OpenSea accounts selling NFTs featuring corporate logos will be hoping to make a quick buck from imagery that will be recognisable to a large percentage of traders. However, that doesn’t mean that buyers won’t be duped into thinking the NFT will give them intellectual property rights related to a brand – just this week, reports emerged of an NFT group that purchased a rare book for more than $3 million and mistakenly believed it gave them the copyright to create NFTs and produce an animated series.

Photograph by Niccolo Chiamori via Unsplash

There is also the danger of confusion. Any major brand that is associated with a popular product should consider monitoring for NFT collections that may look official or endorsed in some way. For example, there are instances of NFTs with Lego models, the most notable of which being the ‘Lego Punks’ collection which features digitally-created Lego heads that are selling for thousands of dollars (with the most expensive being listed for $527,000). There are also accounts that are based on popular fashion items, such as ‘AirJordan1s’ and ‘Supreme Box Logo Collection’.

Indeed, as those in the know have pointed that infringement on OpenSea is really open to anyone to create and sell an NFT, including 'fans' of a particular brand who may not realise the implications of what they are doing. Ultimately, the quicker that action can be taken, the better for the brand owner.

An OpenSea spokesperson responded: “We encourage rights holders to submit reports of IP violations by using our form or following the instructions here.”

With OpenSea growing at such a rapid rate – it captured more than 60% ($14 billion) of the total NFT market in 2021, an increase of over 600 times from 2020's $21 million – it is hoped that it will improve its IP rights protection mechanism going forward.

Source: worldtrademarkreview.com

Editor: IPRDaily-Rene

- I also said the two sentence

- Also you can enter 140words

PurpleVine Successfully Assists Client in Invalidating Sisvel US Patent

PurpleVine Successfully Assists Client in Invalidating Sisvel US Patent Chang Tsi & Partners Successfully Represents Wuxi's First Intellectual Property Civil Case Attached to Criminal Case

Chang Tsi & Partners Successfully Represents Wuxi's First Intellectual Property Civil Case Attached to Criminal Case China Monthly Antitrust Update: February 2024

China Monthly Antitrust Update: February 2024 IPOS was publishing a legal decision involving the trademark of tech giant, Google

IPOS was publishing a legal decision involving the trademark of tech giant, Google